Historically, Bitcoin halvings have acted as bullish catalysts for BTC’s price actions.

These important events reduce the supply of new Bitcoin into circulation every four years. Most significantly, they often trigger bull markets.

For reference, the 2020 halving saw Bitcoin’s price triple, surpassing its previous all-time high of around $19,000.

With the impending Bitcoin halving on the horizon, speculation swirls: could the price surge beyond $100,000, or what are realistic expectations?

In this post, we’ll look the historical impact of Bitcoin halving events and what to expect for Bitcoin’s price in the 2024 halving.

Post Summary

- Understanding Bitcoin Halving

- Historical Price Action of Bitcoin Post-Halving Events

- 2024 Bitcoin Halving: Will BTC Break $100,000?

- Uptrend Or Downtrend: What to Expect

- Conclusion

Understanding Bitcoin Halving

Bitcoin halving is an event that occurs approximately every four years in the Bitcoin network.

During a halving, miners’ reward for validating transactions and securing the network is cut in half.

Not familiar with the term ‘miners’?

Miners are people who verify Bitcoin transactions and secure the network.

In return for their efforts, they receive newly minted Bitcoins, referred to as block rewards

These block rewards represent the primary method by which new Bitcoins enter circulation.

I hope we are clear on that. Now, let’s continue with the Bitcoin halving.

By design, the Bitcoin supply is capped at 21 million.

Approximately every 10 minutes, miners confirm transactions, gradually increasing the circulating supply of Bitcoin.

Satoshi Nakamoto, the creator of Bitcoin, programmed the halving process into the network to regulate the amount of Bitcoin entering circulation.

The Bitcoin halving happens every four years to split the block reward in half. Interesting, right?

Initially, the block reward was 50 BTC when the Bitcoin network launched.

Subsequent halvings have occurred, reducing the reward further. So far, there have been three Bitcoin halvings in the past; details are on the table.

| Halving Events | Reduction of Block Reward |

| November 28, 2012 | 25 BTC |

| July 9, 2016 | 12.5 BTC |

| May 11, 2020 | 6.25 BTC |

The next halving is expected in April 2024, reducing the reward to 3.125 BTC.

As of writing, about 19.67 million bitcoins were circulating, leaving just around 1.35 million more to be mined.

{Suggested Reading} Bitcoin Mining in Everyday Language – A Complete Guide

Historical Price Action of Bitcoin Post-Halving Events

Historically, whenever halving occurred, it played a significant role in driving up the value of BTC.

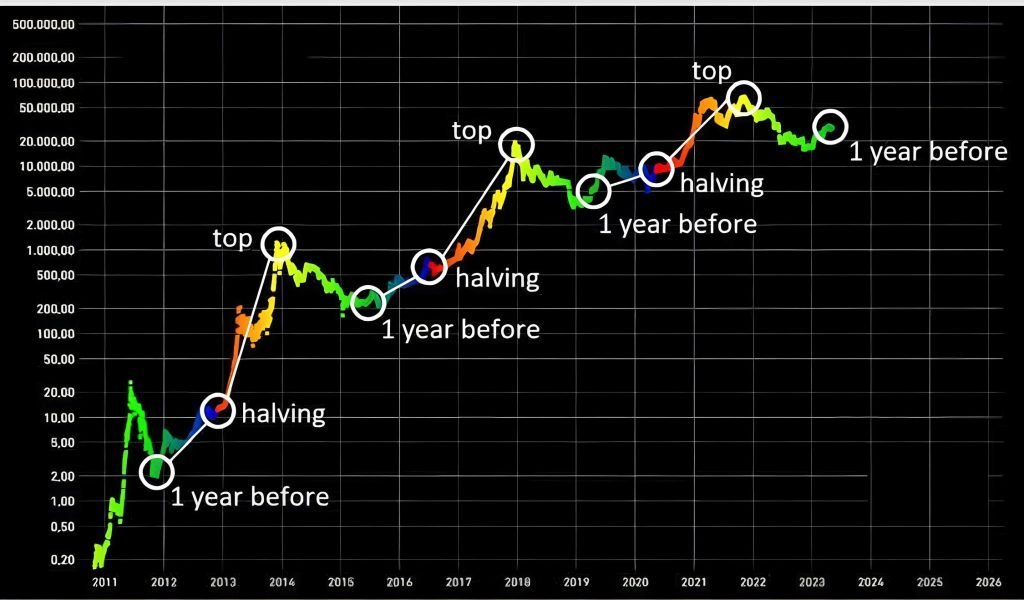

Notably, it has consistently followed a rising pattern, whereby the price of BTC on the day of halving is higher than that of the previous year, subsequently peaking to a new all-time high (ATH).

See the image below.

This table breaks down BTC price movements around halving in more detail.

| BTC Price 1 year Before Halving | Halving Events | Price At Halving | All-time-high (ATH) Post-Halving | Date of ATH | Percentage Increase from Halving Price |

| $2.45 | First Halving: (Nov. 2012) | $15.40 | $1242 | Nov 2013 ( a year after halving) | 7,964% |

| $269 | Second Halving: (July 2016) | $680 | $19,800 | Dec. 2017 (18 months after halving) | 2,812% |

| $7215 | Third Halving (May 2020) | $8,738 | $69,000 | Nov. 2021(18 months after halving) | 699% |

Usually, after the Bitcoin halving event, the price of Bitcoin tends to increase noticeably, and this increase can continue for one year to 18 months, as highlighted in the table.

Also, during this time, the BTC price reaches its highest recorded value or ATH.

However, it’s worth noting that the price increase isn’t always consistent.

Corrections or pullbacks happen as the price surges, both before halving, after halving and after attaining a new all-time high (ATH).

But here is the puzzle: Since Bitcoin’s price reacts positively to each halving event, could Bitcoin surpass $100,000 after the next one or what should we expect?

2024 Bitcoin Halving: Will BTC Break $100,000?

At the time of writing, we are just eight days away from the fourth halving event of 2024, but the bull run is already in full swing.

Surprisingly, the price of BTC has broken through its previous ATH, reaching as high as $74,000, representing a 7% increase from its previous ATH of $69,000.

Unlike previous halving events, this one stands out as unprecedented because BTC’s price typically hits a new ATH post-halving.

Given this bullish momentum at a much earlier stage, it could suggest that we are up for a strong upward trend.

As to whether BTC would surpass $100,000 after halving, there is no reliable metric to measure that.

However, it could easily surpass that if market continues on a bullish path.

In theory, the halving itself doesn’t directly cause a bull run. Instead, the subsequent positive events act as catalysts for a bull run.

Recall how the pandemic, money printing, and low interest rates coincided with the last halving, spurring the bull run.

Uptrend Or Downtrend: What to Expect

There are two likely factors that could catalyze for a bull run post-halving:

- Supply And Demand

This has been the main driver of Bitcoin’s price.

Already, the charts have shown strong demand for Bitcoin, with the price hitting an ATH.

With the next halving, the BTC inflation rate would drop to 1.1%, significantly lower than that of gold.

Again, miners are likely to sell a small portion of BTC. Due to Bitcoin’s high price, even selling a small portion of their reward could be enough to cover their operational expenses.

This scarcity would contribute to the upward trajectory of Bitcoin’s price.

- ETFs

Even before now, Bitcoin ETFs have been much anticipated as a factor that would drive the next bull run.

With the Bitcoin ETF finally approved and substantial capital pouring into this sector, it’s evident that this development is likely a contributing factor to the price of BTC reaching ATH sooner than expected.

ETFs offer a trusted and regulated way to invest.

As a result, the Bitcoin ETF markets are expected to attract more institutional investors, leading to increased liquidity.

The combined effect of increased demand and improved liquidity could lead to a significant and sustainable price spike after halving.

Conclusion

Predicting whether Bitcoin will surpass $100,000 is pure speculation.

The market seems bullish and is gaining momentum upward.

However, the outcome after the halving will probably decide the market’s direction.

What’s your prediction for Bitcoin’s price after the halving?

Share your thoughts in the comments.

If you liked the post, share it using the ‘SM’ buttons below.

0 Comments